According to the office of National Statistics, 90% of business failures are due to Cash Flow issues.

Tracking the Cash Movements and forecasting the available Cash over a period of time in the future is a necessity for every Business.

To estimate the overall Profit of a Business, the owners tend to keep watch over all the activities and processes. As an owner, you will analyze what profit Margin you make through the services you provide and monitor all Business activities and overheads. But, what as an owner you would fail to analyze although having complete insights over inside and out of the cash is,

Whether your business is able to maintain continuous Cash availability in the future by surpassing the upcoming changes in sales, general Business cost, and variation in demand among the public or not?

During the time of Uncertainty, Is your Business capable to surpass significant instability because of sufficient Cash available?

Thus, Cash being King for any Business, predicting its availability in the upcoming future over a given period of time is inevitable. Let us first know what does Cash Forecast actually means before going into detail about its importance of implementation in Business.

What is Cash Forecast?

Cash Forecast is a methodology that helps to predict and estimate the financial position of the Business by doing statistical analysis over the amount of money that comes IN and OUT of the Business by considering all areas of Incoming Cash via business services that you provide and Outgoing Cash with regard to Payments, Expenses, and Investments.

This methodology by displaying a complete blueprint of Cash whether it is Incoming or Outgoing considering all the constraints acts as the most important tool for aiding to make decisions on activities like funding, investments, and capital expenditure.

Cash Forecast can be calculated over a range of time horizons based on your requirements.

All in one, at any given time Cashflow Forecast, lets you know the available Cash at present as well as for a particular time period in the Future that can be utilized for various activities related to investments, charity, Business Expenses, and many more.

Why is Cash Forecasting Important?

It is important to recognize that at the end of a given month a company’s profit does not mean that this much cash is available in the business. Even the most profitable Company may face a Cash shortage for a certain period of time.

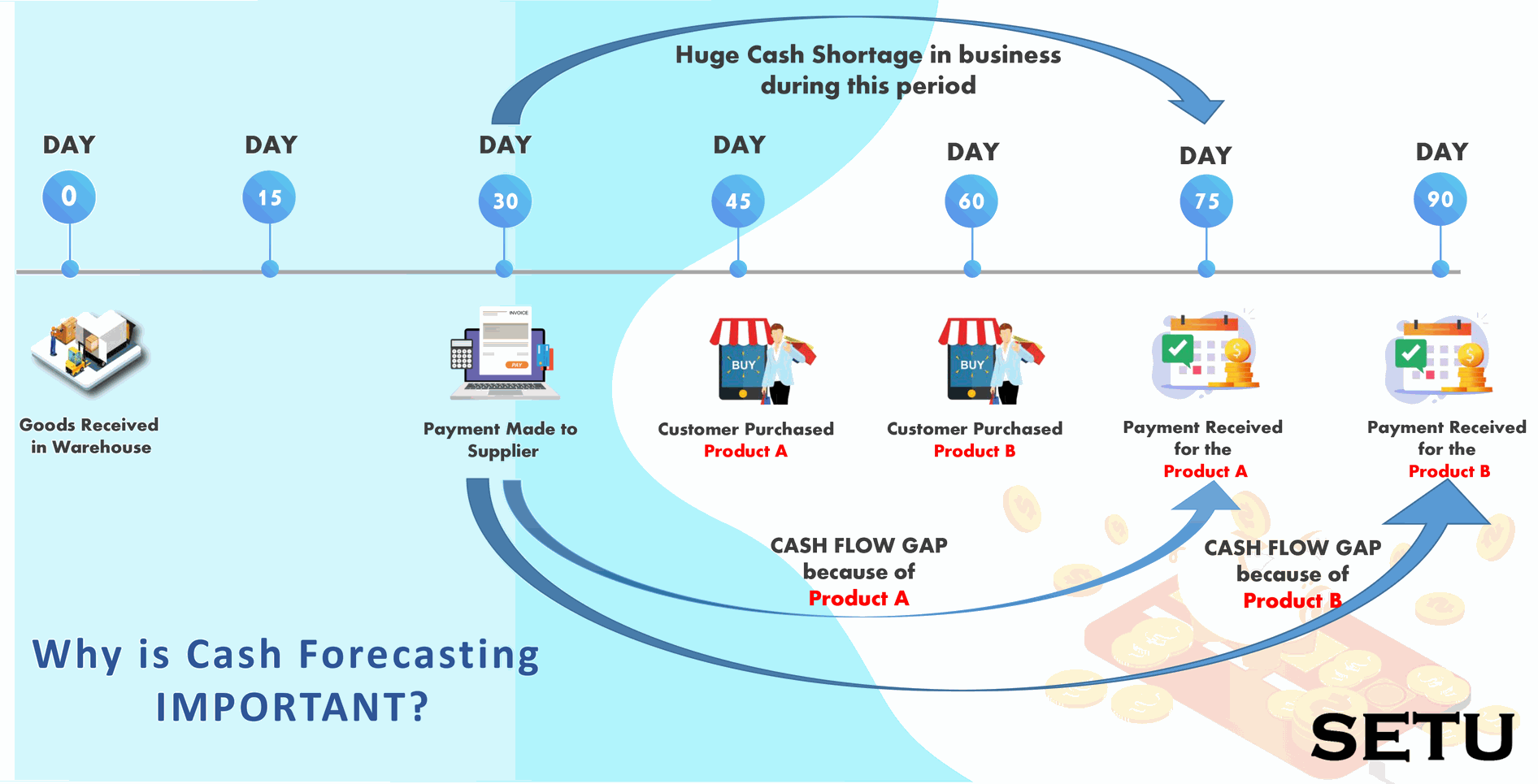

A simple example of a Product selling Business that explains most profitable companies may even face Cash shortages for a short period of time.

Company XYZ sells Product A and Product B by selling them at Retail price after purchasing them from a vendor at wholesale Price.

They Purchase Products from the same supplier, but it tends to have stock on hand for 45 days for Product A and 60 days for Product B before it is sold

The company is given a 30-day Credit Period and it also gives a 30-day credit period to its Customers.

Based on the diagram, there is a gap of 45 days between paying the Vendor and receiving the income with Profit from the Customers by selling to them surpassing the 30-day Credit Period.

For Product B, there is a gap of 60 days between paying the Vendor and receiving the income with Profit from the Customers by selling to them surpassing the 30-day Credit Period.

From the diagram, it is clear that along with CashFlow shortage for individual products i.e. for product A a gap of 45 days and for product B a gap of 60 days, for days from 45th day to 75th day there is a Cashflow shortage for both products which may prove to be stressed out period for Company in terms of available Cash though it earns Huge Profit.

Well, this is an example of only 2 Products, but when a Company were to sell multiple other Products, all of them having varying lead times for Cash recovery,

How would Company know and decide How much Cash they have at any time?

Well, it is the Cash Forecast methodology that not only estimates data analytics of Incoming and Outgoing Cash but as explained in the above example lets you know the available Cash at present and What Cash you can expect in the Upcoming Future?

Likewise, without knowing the future of On Hand Cash availability the situation can become even more complicated if you add to this wages, payroll taxes, VAT, corporation tax payments, loan repayments, and other overheads.

As Sir Richard Branson puts it “Never take your eyes off the cash flow of a business because it is the life and blood of a business.”

Moreover, this example also explains that though Business is going through tremendous growth and Optimum Profit, during the CashFlow gap, because of the Cash shortage you may find yourself in a situation where you are unable to fulfill new Orders. This may lead to a loss in Profit Margin.

But by plotting out expected Cash and its movements in advance, you can now plan for future investments accordingly.

This clearly indicates implementing the Cash forecasting strategic tool leads Businesses to the best performance with aspects of the Best decision-making strategies.

Major Benefits of Cash Forecast

➔ Identify and plan over the Surplus Cash

At any given period, Forecasting the available Cash after considering all constraints of Incoming and Outgoing Cash, the Surplus amount that remains lets you take decisions over

How much Cash can be Invested for expansion and Growth?

And by also knowing the Future expenses and probable Future Incoming cash you can also decide

How much Cash you should preserve at present for Future expenses to surpass the Future Cash shortage?

➔ Identify the reason for the Cash shortage

Forecasting the Cash movements also lets you

That lets you plan various strategies to get rid off, of this shortage period scenario with the smooth flow of all Business processes.

➔ Plan during Cash Shortage

Forecasting the cash, when time is tough because of any reasons being natural calamities and/or the market is shifting, CASH is the King and liquidity will help you to see the business through.

Young entrepreneurs usually focus and shift their entire energy on generating and increasing the profit of the business. The urge to lead the competition by making higher profits can often overshadow the need to manage and maintain their cash efficiently. As a result, this mismanagement often leads to cash shortfalls due to which most startups either start borrowing or just fail. 42% of SMEs consider cash flow as an obstacle to their success as per a survey carried out by the Department of Business and Innovations Skills.

➔ Identify and plan to reduce the time of Incoming Cash

The cumulative Cash movements forecast shows details of

● On which date, Cash is coming back to your Business due to services that you provide?

lets you plan strategies and ideation on

● How to deal with Customers to reduce the overall time of payment made by them?

➔ Track Business expenditures

While considering the overall expenses of Business as Outgoing Cash, it becomes easy for the owner to take necessary decisions over the reduction of expenditures during Cash shortage and also during Surplus Cash available can do expenses over maintenance

➔ Analysis over Bank Balances made easy

Keeping track of Withdrawals and Deposits, Expenditures, Invoices pending to Receive and many more parameters inbound directly with Cash is possible that leads you to come to a conclusion over changes that should be done to improve available cash.

Agreeing to the benefits and importance of Cash Forecasting of Business the question here arises is How to implement the most affordable Cash Forecasting model?

All in One Solution

The best analysis of Cash Movements is essential to help a business grow, so why would you deny to predict future expenditure and future Incoming sources of Cash and be prepared in advance for all constraints that are to come in the future? Most simple and highly advanced most User-friendly Cash Forecasting solution is available which aims at supporting your Business to take the best decisions based on the most accurate data considering all contrainments for both

Incoming cash like

● Payments based on Sales in Business

● Interest because of Investments

● Tax Refunds

● Returns because of Investments

And Outgoing Cash movements like

● Loan Payments

● Rental payment

● Office expenditures including maintenance expenses

● Salary of employees